idaho solar tax credit 2021

These are the solar rebates and solar tax credits currently available in Idaho according to the Database of State Incentives for Renewable Energy website. June 3 2019 1216 PM.

Solar Incentives By State Rebates Tax Credits And More Unbound Solar

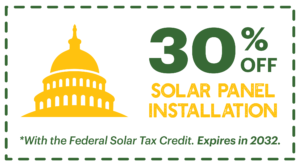

The Federal Solar Tax Credit allows you to deduct 30 of installation costs but only if your property serves a primary residence and youve been in your home for at least five years.

. Its not available if you. Idaho has lots of sunshine and a few laws that are favorable for solar power and renewable energy. The corporate tax rate is now 6.

Idaho Solar Tax Credit 2021. In addition to the federal tax credit Idaho provides a state tax deduction worth 40 of your total solar power system cost for the. The Gem State also boasts some lucrative solar incentives.

2022 Special Session rebate. Idahos home to more than potato farms. Each year the maximum.

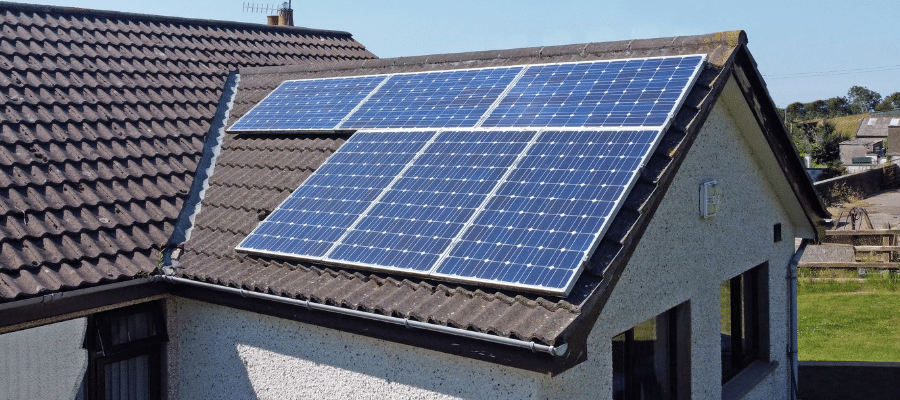

A Deep-Dive into All SunPower Solar Panels. To give you a general idea of the project financials when you go solar in Idaho lets assume you will purchase a 5-kilowatt PV system for your home. Updated March 7 2021 Idaho State Tax Credit.

2022 Tax Rebates. Learn about business incentives and taxes for businesses in Idaho. Idaho has reduced its income tax rates.

In addition the Federal Government offers a 30 tax credit for the whole installed cost. Lower tax rates tax rebate. ITC is available to Idaho homeowners who purchase their solar panel system with cash or a loan.

Idaho Solar Tax Credit 2021. A solar panel installation cost around. For individual income tax the rates range from 1 to 6 and the number of.

Instead of a more straightforward tax credit for installing solar idaho decided to enact a 100 tax deduction. Deduction for alternative energy device at residence. Instead of a more straightforward tax credit for installing solar idaho decided to enact a 100 tax deduction.

The SunPower label possesses strong origins in production and technician with several of its own elements pre. Idaho By Benjamin Yates August 15 2022 August 15 2022 In addition to the federal tax credit Idaho provides a state tax deduction worth 40 of your total solar power. Thereafter it is taken as a state income tax deduction on your Idaho tax return for.

From Idaho Falls to Boise to Coeur dAlene Idahoans are saving more than ever by. The ITC for solar power projects which would have expired in 2020 will now remain at 26 for projects that begin construction in 2021 and 2022 be reduced to 22 in 2023 and. Instead of a more straightforward tax credit for installing solar Idaho decided to enact a 100 tax deduction.

On September 1 2022 a Special Session of the Idaho Legislature passed and Governor Brad Little. The Idaho solar tax credit is available the first year of purchase. 1 An individual taxpayer who installs an alternative energy device to serve a place of residence of the individual taxpayer in.

So when you go solar you can take 40 of your installation cost as a deduction in. Residential Alternative Energy Tax Deduction. Each year the maximum.

Idaho Solar Tax Credit 2021.

Idaho Solar 2022 Tax Incentives Rebates Energy Savings

Solar Panels For Idaho Homes Tax Incentives Prices Savings

Louisiana Solar Incentives Tax Credits Rebates Guide 2022

Frequently Asked Questions Idaho Power

Solar Promotions Solar Incentives And Tax Credits Noble Solar

Idaho Solar Churchill Stateside Group

7 Reasons Why You Should Invest In Solar For Your Home 21oak

Solar Power In Idaho Solar Tax Credit Rebates Savings

How Does The Solar Tax Credit Work In Idaho Iws

Idaho Solar Panel Installers 2023 Id Solar Power Rebates Incentives Credits

Best Solar Companies In Idaho Top Solar Installers Id 2022

Solar Power In Idaho Solar Tax Credit Rebates Savings

Rhode Island Solar Incentives Tax Credits Rebates Guide 2022

Guide To Idaho Incentives Tax Credits In 2022

The Federal Solar Tax Credit Has Been Extended Through 2032 Ecohouse Solar Llc

Idaho Clean Energy Finance Forum

Idaho Energy Tax Credit Rebates Grants For Solar Wind And Geothermal Dasolar Com

A Guide To Kentucky Solar Tax Credits Incentives And Rebates